46+ where does mortgage interest go on tax return

To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. Efile your tax return directly to the IRS.

Proof Of Income Letter Examples 13 In Pdf Examples

If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying residence.

. File your taxes stress-free online with TaxAct. Ad Free means free and IRS e-file is included. Web Mortgage Interest Credit.

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. And lets say you also paid. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

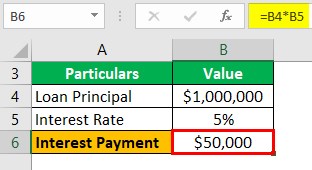

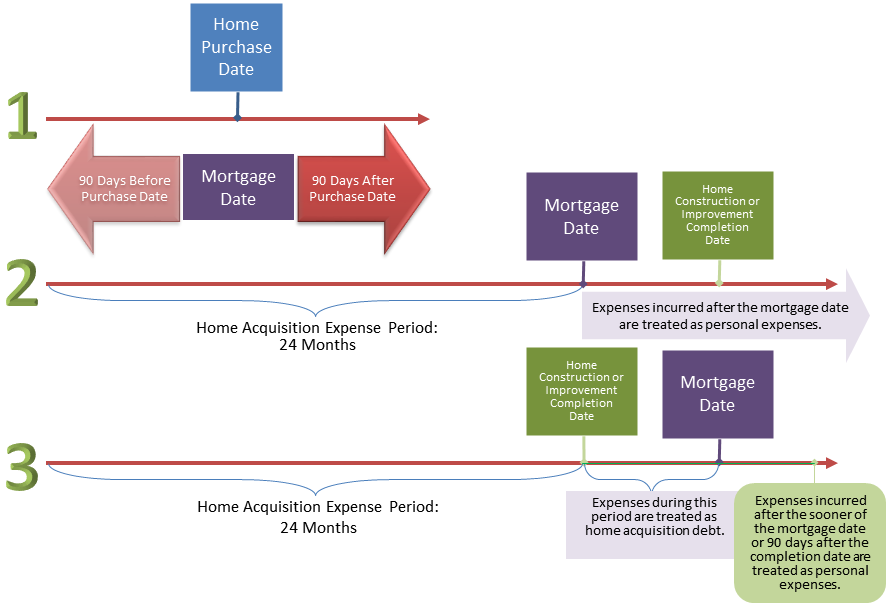

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Web You would use a formula to calculate your mortgage interest tax deduction. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

TaxInterest is the standard that helps you calculate the correct amounts. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Max refund is guaranteed and 100 accurate.

Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. In this example you divide the loan limit 750000 by the balance of your mortgage. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large.

So lets say that you paid 10000 in mortgage interest. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Web Entering mortgage interest on tax return self assessment 04-07-2021 1144 AM Hi I have heard that the tax relief on mortgage interest has altered this year.

Web Who qualifies for the mortgage interest tax deduction. Filing your taxes just became easier. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Beginning in 2018 the limitation for the amount of home.

For tax years before 2018 the interest paid on up to 1 million of acquisition. TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions. You may be able to take a credit against your federal income tax for certain mortgage interest if a mortgage credit certificate MCC.

Web Open your return. 100 Free Tax Filing.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Is Mortgage Interest Deductible On Your Income Tax Return For 2017

Independent Houses In Sector 46 Gurgaon 46 Houses For Sale In Sector 46 Gurgaon

How Do I Claim The Mortgage Interest Deduction

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Understanding Taxes Interest Income

3 Ways The Mortgage Tax Relief Changes Impact You Taxscouts

Mortgage Interest Deduction How It Calculate Tax Savings

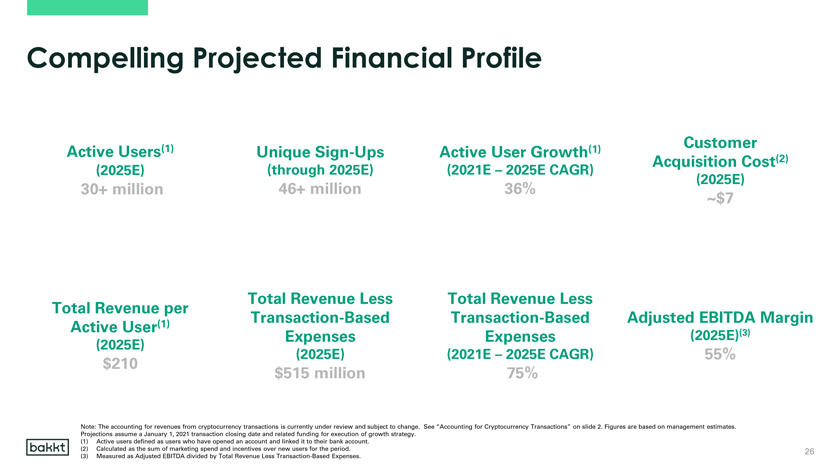

Ex 99 2

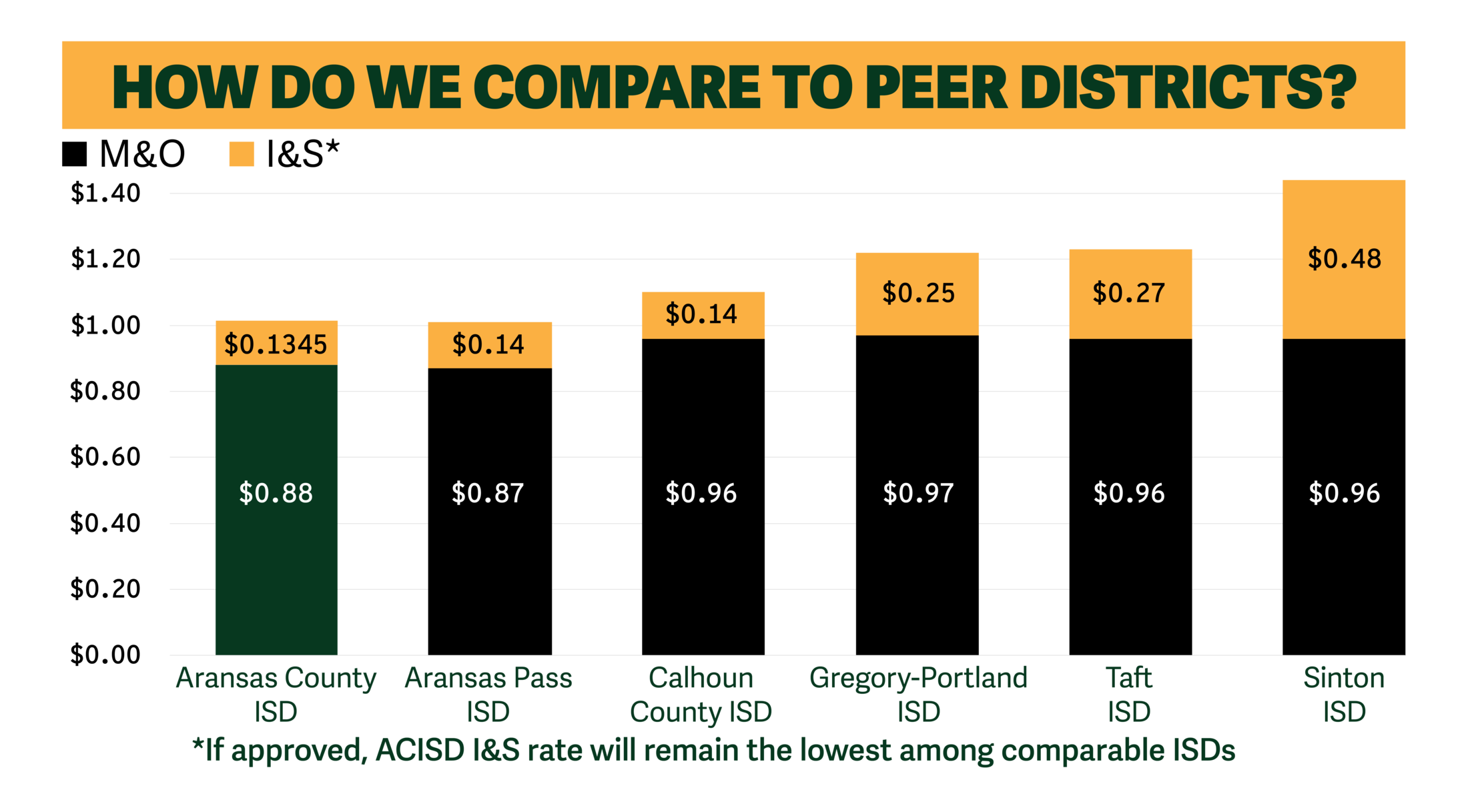

Faq 2022 Bond Aransas Co Independent School District

Independent Houses In Sector 46 Gurgaon 46 Houses For Sale In Sector 46 Gurgaon

The Future Of American Housing A Mcmansion Withdrawal Rethinking Commutes Designing Housing With Lower Incomes In Mind And The Impact Of A Fully Subsidized Mortgage Market Dr Housing Bubble Blog

Kghdjx3hhj 3vm

Flats Apartments In Sector 46 495 Flats Apartments For Sale In Sector 46 Gurgaon

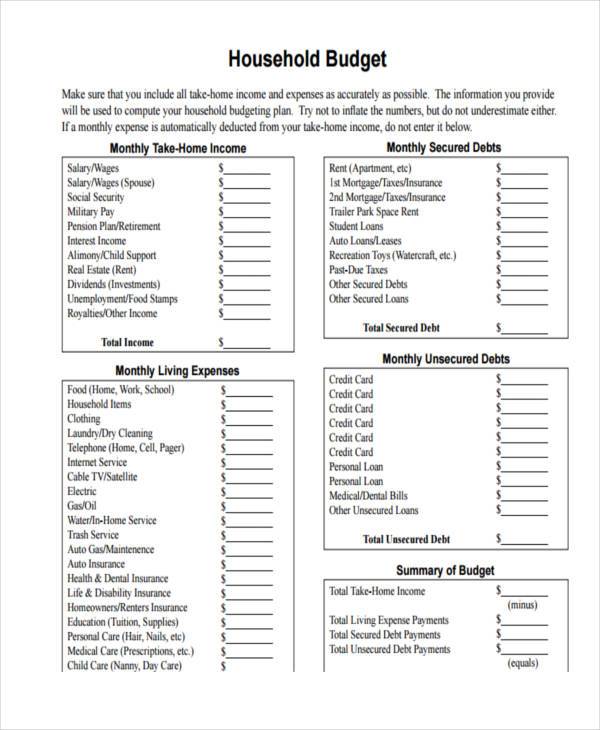

Free 46 Budget Forms In Pdf Ms Word Excel

Independent Houses In Sector 46 Gurgaon 46 Houses For Sale In Sector 46 Gurgaon

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans